Contractors across the U.S. want to know where things stand in 2025. Are backlogs rising? Is work still steady? And what does this mean for future growth? According to recent data from ABC’s construction backlog indicator, the answer is a mix of good news and warning signs.

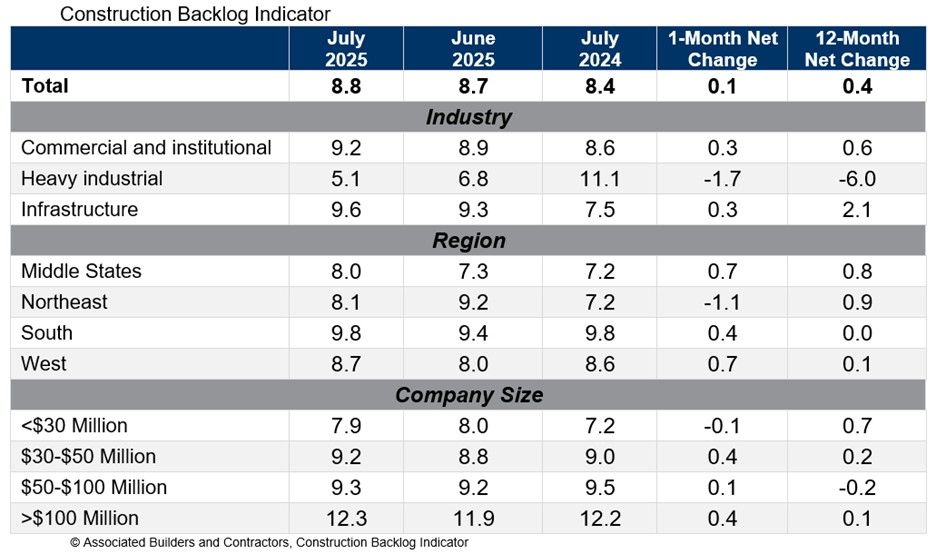

The Associated Builders and Contractors (ABC) found that the construction backlog remained steady through the first half of the year, averaging between 8.4 and 8.8 months of work. In July, backlog rose slightly to 8.4 months, after dipping in June. While this suggests a level of stability, the numbers haven’t made a big jump despite growing demand in some areas.

“While many other economic sentiment readings have deteriorated in recent months, contractors remain optimistic that business conditions will improve through the first half of 2025,” said ABC chief economist Anirban Basu, in a press release. “These hiring expectations suggest that the recent slowdown in industrywide employment is largely confined to the residential segment,” Basu added. “Yes, there are some broader signs of emerging economic weakness, but the results of this ABC member survey suggest that contractors will remain busy over the next few quarters.”

One of the bright spots is data center construction. With artificial intelligence and cloud computing on the rise, more companies are building or upgrading these high-tech facilities.

Public infrastructure is another factor helping to keep backlogs afloat. Projects funded through the Infrastructure Investment and Jobs Act continue to roll out across the country, from highways to bridges to water systems. These projects tend to be large, long-term builds that give contractors some breathing room and visibility into their pipeline.

However, not every firm is feeling the boost. According to ABC, contractors with $30 million to $100 million in revenue saw their backlog shrink in recent months, while larger firms were more likely to report growth. Smaller teams may be struggling with fewer bidding opportunities, workforce challenges, or tighter margins.

Another issue is contractor confidence. Even though work is available, some contractors are feeling nervous about rising costs and tightening margins. In July, ABC’s Construction Confidence Index declined for both sales and profit margin expectations, though staffing confidence actually increased, reaching its highest level since April.

Construction Backlog Indicator, from ABC.org:

There’s also renewed anxiety around tariffs, especially as global trade tensions flare up again. Ongoing uncertainty about the cost and availability of materials, such as steel, aluminum, and electronics, can make it harder for contractors to confidently price jobs or lock in schedules. Many recall the 2019 slowdown that followed the tariff battles with China, and there’s concern that another round of trade disruption could once again impact backlogs and margins.

For now, the construction backlog indicator remains steady. That’s not necessarily bad news. In a time when the economy is full of mixed signals, a stable backlog offers some reassurance. However, it also means that firms need to stay sharp, flexible, and ready for changes, especially smaller companies that are working to stay competitive.

Want more updates on the construction industry’s outlook? Subscribe to our newsletter for weekly insights, stats, and trends.