AI data center projects used to be an afterthought in regional construction plans. Now they’re treated like trophy projects, with governors cutting promo videos to court tech giants, power utilities rewriting long-term plans, and contractors lining up for billion-dollar builds. The rise of hyperscale cloud and AI infrastructure has put states into direct competition, each trying to prove they can offer cheap power, shovel-ready industrial land, and fast permitting as the companies behind these projects want to move fast and build big.

States which are pushing policies to attract data center construction

Virginia

Virginia still dominates with what industry insiders call the “Data Center Alley” effect. Loudoun County alone contains millions of square feet of white space dedicated to data storage. Local officials refined their approval process so thoroughly that developers know exactly what to expect. Contractors familiar with the area often mention how predictable scheduling and inspection sequencing have made it one of the most construction-friendly regions in the country for building AI data center projects.

Virginia’s edge comes down to repeatable, contractor-aware policies:

- Predictable permitting timelines geared toward large power infrastructure

- Established power utility relationships with clear upgrade pathways

- Existing high-capacity fiber corridors are already in place

Ohio

Ohio has become a serious contender for attracting funding for AI data center projects by pairing tax exemptions with land deals structured for speed. Property tax abatements tied to job creation numbers are common, but what sets Ohio apart is its aggressive collaboration with utility companies to guarantee future electrical capacity. Columbus has transformed into a construction hotspot, signaling to hyperscale builders that the grid will grow with them, not hold them back.

Texas

Texas leans on its energy history. Utility-scale solar farms, gas generation sites, and industrial-zoned land have put it on data center site selectors’ shortlists. Counties outside Dallas and San Antonio are offering incentives that extend beyond basic tax relief. Some agreements include commitments to upgrade substations and fast-track high-voltage transmission permits. General contractors in these regions are collaborating with engineering teams earlier than ever to secure long-term campus build-outs that unfold in multiple phases.

Arkansas

Arkansas, less expected on the list, is aggressively marketing its low energy rates and available land to attract more AI data center projects. Officials pushed through legislation to streamline permitting around heavy utility use. Development authorities are tailoring agreements directly to hyperscale operators, signaling flexibility in deal structures. Contractors used to light industrial builds are retraining staff in raised floor installation, liquid cooling integration, and medium-voltage electrical work to stay competitive.

Construction strategies shift as grids strain and tech demands climb

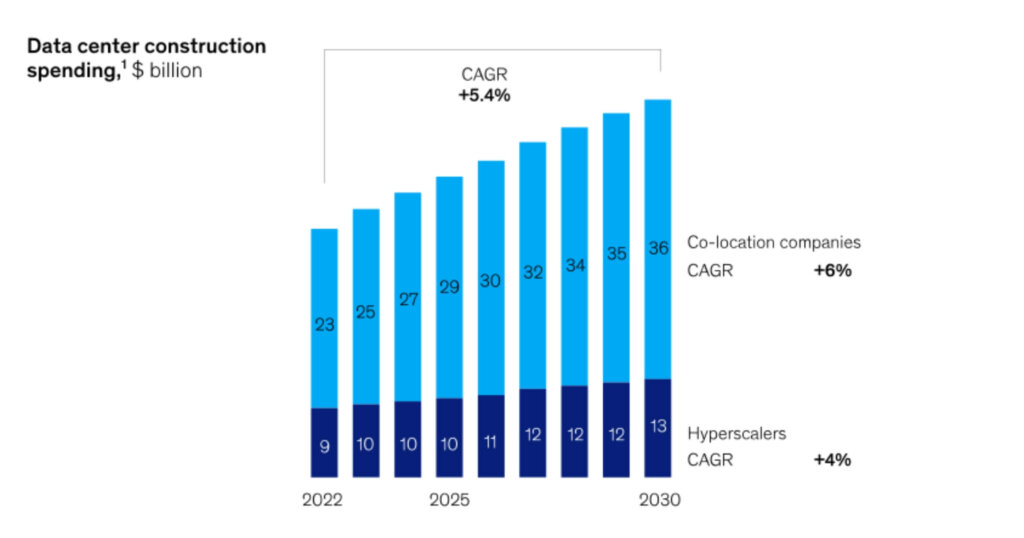

State governments are closely monitoring which companies they secure because the deal volume is staggering. Data center construction is projected to pump billions into regional construction pipelines, not just in California or Virginia, but across the Midwest and Southeast. Contractors who usually work on steady public sector or warehouse builds are now bidding on single campuses valued higher than several municipal projects combined.

Data center construction spending projections to 2030. Image sourced from https://www.mckinsey.com/.

Standard adjustments happening across construction firms to bid for AI data center projects include:

- Investing in modular framing lines for repeatable hyperscale designs

- Early coordination with electricians to handle high-capacity switchgear

- New project management roles focused solely on utility coordination

Energy providers are now some of the most influential decision-makers in these deals. Midwestern and Southern utilities are reporting that data center demand could require grid expansion on a scale typically associated with manufacturing booms. High-voltage crews, substation contractors, and power systems engineers are securing multi-year contracts tied directly to AI infrastructure growth.

Grid strain and land use have already become friction points between residents and local governments. In public hearings, residents are asking whether tax breaks are worth the strain on infrastructure. Contractors working on these sites report that questions are arising more frequently, particularly regarding whether backup generation will be built in or left to public utilities to handle.

Contractors that adapt early will own the next decade of contracts

Developers are ranking energy availability right alongside tax benefits. AI-driven loads differ from traditional data processing—they pull more continuous power and produce more heat. Engineering firms now design campuses with infrastructure in place for immediate power doubling without a second permitting round. Contractors specializing in renewable tie-ins and battery enclosures are seeing steady crossover work.

On-site shifts are noticeable. Crews report that excavation for conduit runs and transformer foundations resembles utility projects more than commercial tech builds. Municipalities are widening access roads and allocating budget for water service upgrades tied directly to data center cooling demands.

Labor training conversations are growing louder. Some states are actively aligning trade certification programs with data center-specific skills:

- Multi-megawatt electrical room work

- High-volume HVAC and precision cooling systems

- Integrated control and monitoring systems tied to grid interfaces

There’s also an emerging caution against overbuilding. Industry analysts note that speculative shells may be waiting for AI demand, which could shift based on chip availability and changes in cloud architecture. Contractors who saw empty distribution centers linger in past development cycles are approaching multi-phase data projects with a more measured long-range staffing mindset.

Architects and engineers involved in active data center work say every design meeting now includes assumptions about expansion. Mechanical engineers are specifying gear above current load needs, and safety officers are adapting site plans around high-voltage routing and round-the-clock staging.

States are no longer chasing these projects just for short-term job spikes. They’re positioning them as anchors for long-term infrastructure build-out: fiber corridors, high-capacity substations, rail connectivity for component logistics, and permanent O&M contracts. Construction firms that adjust early—especially those able to speak the same language as hyperscale tech procurement teams—will hold an edge as more sites break ground.

The building wave is here, and it’s changing how trades approach planning, estimating, power management, and long-term labor development. The cranes, conduit runs, and pad pours happening today are only phase one of what could turn into decades of repeat expansion contracts.

If tracking where AI infrastructure turns into real construction work matters to you, get on the list at Under the Hard Hat—that’s where we continue following the contractors, site packages, and utility deals shaping the next wave of data center builds.