According to Lodging Econometrics, in Q2 2024, total hotel pipeline growth reached 9%, with upper midscale leading some segments and the extended stay category remaining strong. As of the end of the quarter, there were 713,151 rooms and 6,095 projects in the pipeline.

Increases by the numbers

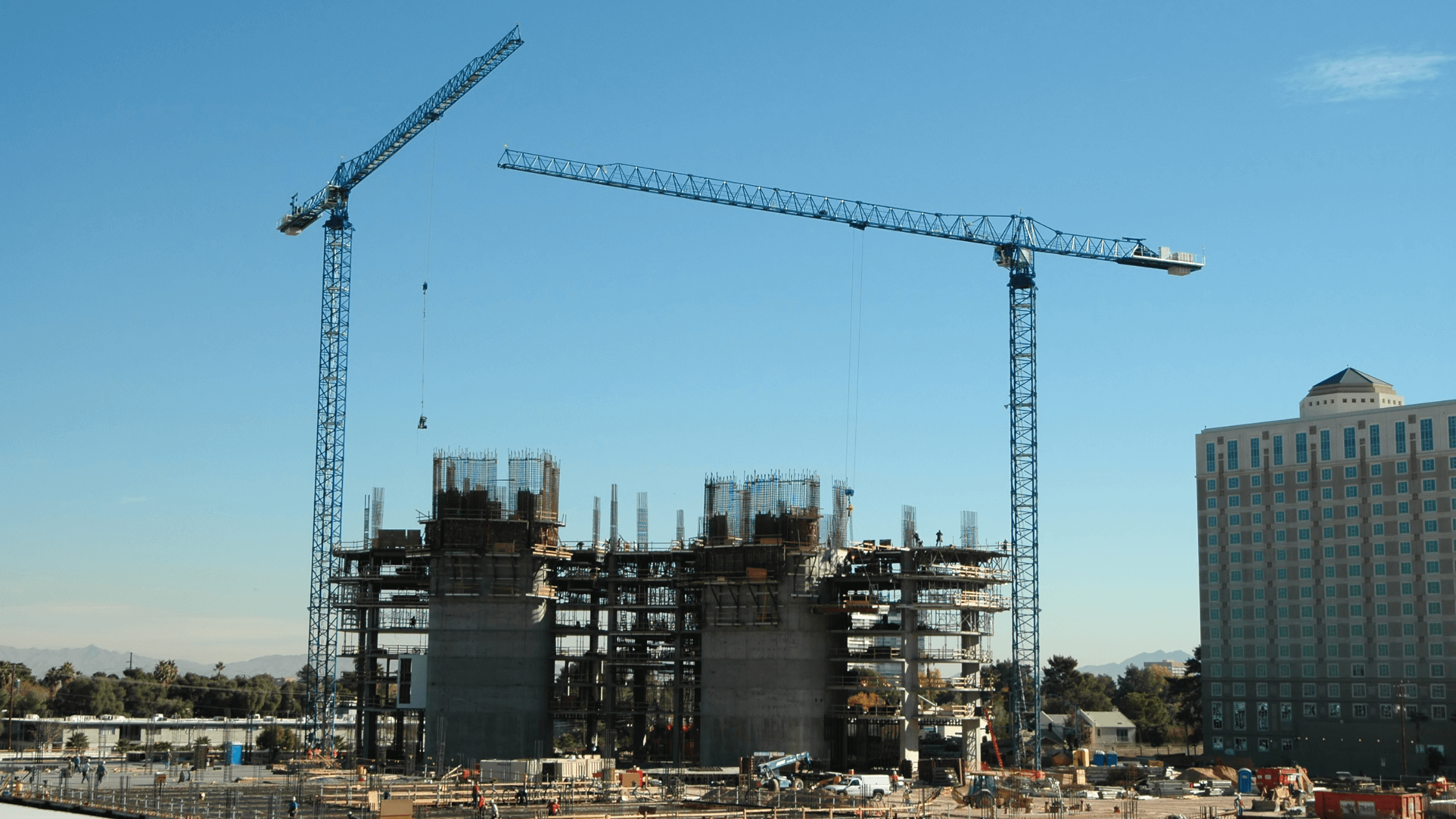

When we look at the under-construction numbers, there’s a 10% increase in projects and a 4% increase in rooms YOY. Projects scheduled to start construction in the next year total 2,350 projects with 268,378 rooms, bringing the numbers up to a 5% increase in projects and a 3% increase in rooms YOY.

Projects and room counts in the early planning stages increased by 13% and 15%, respectively. Lodging Econometrics expects construction to begin rather quickly as interest rates start to decline.

Segments on top

Accounting for 2,262 projects and 219,547 rooms, the upper midscale chain scale has the most significant project count of all segments in the Q2 pipeline.

Trailing behind in second place is the upscale chain scale with 1,417 projects and 175,343 rooms. Combined, they comprise 60% of total pipeline projects. In terms of category, brands in extended stay hold strong with developers, making up 36% of all under-construction projects.

For the remainder of 2024, Lodging Econometrics forecasts another 400 projects, bringing the yearly total to 650 new hotels and 74,228 rooms. The 2024 year-end forecast brings a 35% increase in hotels opened from 2023. And the increases show no signs of slowing. Growth is expected to increase by 1.8%, with 2025 forecasted for 779 hotel openings and 2026 with 928.

Location location location

New York City, with 23 openings, claims the top spot for the most hotels opened by year-end. Dallas follows behind with 16, Atlanta with 15, Inland Empire with 14, and Orlando with 13.

Many common lower-scale hotel brands are expanding into upscale and extended stay categories. Hyatt has launched Hyatt Studios, its first venture into the upper midscale extended stay category, and Marriott has broken ground on the first development under their new StudioRes brand. As the U.S. hotel pipeline continues to grow, consumers can expect brand additions and expansions to grow in tandem.