Modular construction isn’t a new idea, but in 2025, it’s finally stepping into the spotlight. Instead of building everything piece by piece on a jobsite, entire sections of a project are crafted in factories, shipped out, and fitted together like building blocks. The result? Faster timelines, fewer delays, and often a lower price tag. After reaching $20.3 billion in market value in 2024—about 5.1% of total U.S. construction activity—the sector is projected to climb to $25.4 billion by 2029. What’s fueling this rise goes beyond speed and savings: a nationwide housing crunch, ongoing labor shortages, and supply chain headaches are pushing builders toward off-site solutions. Adding mounting sustainability goals, rapid advances in digital design and robotics, and new policies that cut red tape, modular construction has become less of an alternative and more of a frontrunner in how America builds.

Quick look

- U.S. modular construction hit $20.3 billion in 2024, with projections to reach $25.4 billion by 2029.

- More than 55,000 modular housing units are expected to be built in 2025, up from 42,000 in 2024.

- Housing shortages, skilled labor constraints, supply chain volatility, sustainability, and net-zero targets are all driving the demand for modular housing.

- Modular methods can cut project costs by up to 25% and speed timelines by 30–50%.

- The adoption of modular construction is expanding into various sectors, including hotels, schools, healthcare facilities, and energy projects.

What is off-site construction?

Off-site construction refers to building a significant portion of a project away from the jobsite itself. Walls, floors, or even entire room-sized modules are put together in a factory setting, where conditions are consistent and tightly controlled. Once complete, those pieces are hauled to the site and assembled into the finished structure. It’s the opposite of the traditional model, where every step—from framing to finishing—takes place out in the field.

Types of off-site construction include:

- Volumetric modules: Three-dimensional units that include internal finishes, fixtures, and fittings.

- Panelized systems: Two-dimensional panels such as walls, floors, and roofs that are assembled on-site.

- Modular homes: Pre-designed homes built in sections in a factory, then transported and assembled on-site.

History and cost challenges of modular construction

Modular construction isn’t a recent invention—it’s been part of the building world for generations. Post-war housing shortages in the 1940s and ’50s saw early versions of prefabricated homes shipped out to neighborhoods almost overnight. Between 1945 and 1960, for example, more than 800,000 prefab homes were erected across the country under programs that leveraged federal loans and mass production methods. Schools, military housing, and temporary offices followed, proving the concept could work at scale. Yet despite these examples, modular carried a stigma for decades. Many people associated it with flimsy “mobile homes,” assuming that off-site meant lower quality.

Financing added another layer of difficulty. Banks and insurers were slow to embrace modular projects, often treating them as riskier than conventional builds. Developers faced added costs and delays trying to secure funding, even when modular could deliver faster returns. Regulators also played a role—local building codes weren’t written with factory-built methods in mind, forcing projects into lengthy approval processes or double inspections.

These obstacles may have slowed modular’s momentum, but they never stopped progress completely. While financing and regulatory hurdles still pose some challenges, the industry has moved beyond the old stereotypes. Modular construction is no longer viewed as a shortcut—it’s proving itself as a serious, long-term player in how we build.

Market growth and demand drive offsite construction

The American prefab and modular construction sector has moved from the margins to a central role in the building industry. Industry data indicate that the market reached $20.3 billion in 2024 and is projected to grow to $25.4 billion by 2029, representing an annualized growth rate significantly higher than that of traditional construction. In 2025 alone, the U.S. is on pace to see more than 55,000 modular housing starts, a substantial jump from the roughly 42,000 units recorded in 2024. This makes 2025 a breakout year for off-site building, especially in regions where housing demand has been most severe, such as California, Texas, and the Northeast corridor.

The U.S. has long trailed countries such as Sweden, Japan, and the U.K., where modular housing makes up a far larger share of new construction. That gap, however, is starting to narrow. In the U.S., modular isn’t just gaining ground in residential projects; it’s also showing up in hotels, hospitals, and schools, where speed and cost savings are just as valuable as quality. Developers who once viewed prefab as experimental are now treating it as a mainstream delivery model. With factories scaling up production capacity and large developers committing to modular portfolios, the U.S. market is finally showing the kind of year-over-year growth that has been common in other parts of the world for more than a decade.

What’s driving the surge for modular construction in 2025

Several forces are converging to make 2025 a turning point for modular construction. The most pressing issue is the nationwide housing shortage, with demand for affordable homes outstripping supply by millions of units. As a result, developers need faster and more reliable delivery models. Modular construction can cut build times by 30–50%, giving it a decisive advantage. At the same time, the skilled labor shortage, exacerbated by retirements in the trades and a slow pipeline of new workers, has made conventional construction more expensive and unpredictable. Factory-based modular production helps offset these shortages by concentrating labor in controlled environments where efficiency is higher.

Two carpenters working on a wooden frame for prefabricated house. Photo courtesy of Shutterstock.

Supply chain volatility has also driven interest. By sourcing and assembling materials in centralized facilities, modular builders can insulate projects from shipping bottlenecks and price swings that have hampered site-built construction. Sustainability is another powerful driver: modular methods reduce material waste, cut transportation emissions, and make it easier to achieve net-zero performance standards. For cities and states under pressure to meet climate targets, this alignment is increasingly important.

Technological advances are also accelerating adoption. From digital twin modeling to robotic assembly lines, innovations are making modular units more customizable, durable, and aesthetically appealing—dispelling outdated perceptions that prefab means cookie-cutter design. Finally, recent regulatory shifts have lowered barriers. States such as California, New York, and Washington have introduced streamlined approvals, standardized building codes, and even financial incentives to encourage off-site development.

Internationally, these drivers are familiar—Scandinavian nations have long embraced modular for its sustainability, while Japan has refined prefab systems to deliver earthquake-resistant housing at scale. What’s new is that the U.S. is now catching up, with policy, technology, and demand all aligned at the same time. The result is a construction landscape where modular is no longer a niche alternative, but a mainstream solution shaping the future of American building.

Modular construction cost: Breaking down the numbers

Modular construction offers several cost advantages over traditional building methods:

- Lower labor costs: Factory-based construction reduces the need for on-site labor, leading to cost savings.

- Faster timelines: Concurrent off-site and on-site construction activities can reduce project timelines by 25% to 50%.

- Fewer delays: Controlled factory environments minimize weather-related delays and other on-site disruptions.

- Up-front factory investment vs. long-term savings: Although an initial investment in factory setup is required, the efficiency gains and reduced labor costs result in long-term savings.

For example, the Cal Poly San Luis Obispo student housing project utilized modular construction to deliver 4,200 new beds, reducing costs by 25% and construction time by 30% compared to traditional methods.

Case studies that prove modular construction is here to stay

Cal Poly San Luis Obispo student housing:

Photo courtesy of https://www.steinberghart.com/

In response to increasing student enrollment and rising housing costs, Cal Poly embarked on a $1.2 billion modular housing project to add 4,200 on-campus units by 2030. The use of modular construction allowed for faster and more cost-effective development, serving as a model for addressing housing shortages in urban areas.

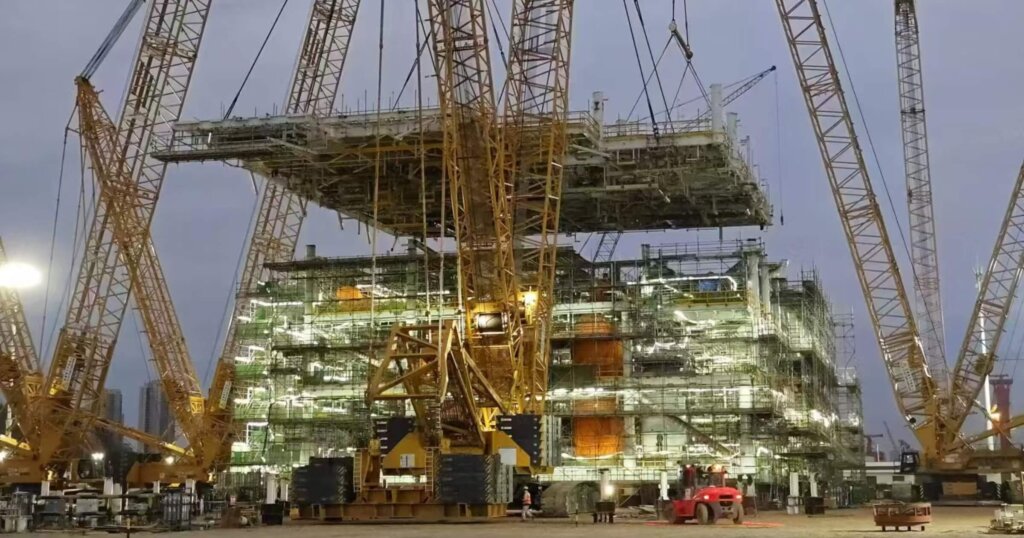

LNG projects using modular construction:

Photo courtesy of https://woodfibrelng.ca/

To mitigate rising costs and construction delays, U.S. LNG developers are adopting modular construction methods. For instance, the Rio Grande LNG export facility in Texas is utilizing modular build processes to reduce labor and equipment costs. This approach enables faster project completion and cost savings, essential for meeting the growing global demand for liquefied natural gas.

Modular disaster recovery housing:

Photo sourced from https://spectrumlocalnews.com/

In the aftermath of the 2023 Maui wildfires, modular housing played a crucial role in providing temporary and permanent shelter to displaced residents. Companies like Fading West and Guerdon delivered over 100 modular homes to Lahaina, offering fire-resistant and durable housing solutions. This rapid deployment of modular homes demonstrated their effectiveness in disaster recovery scenarios.

Outlook for modular construction: What modular means for the future

As of 2025, modular construction is no longer a niche solution but a mainstream approach in the building industry. Its ability to address housing shortages, reduce construction costs, and align with sustainability goals positions it as a key player in future development projects. With continued advancements in technology and supportive policies, modular construction is set to play a significant role in shaping the future of housing and infrastructure.

For more in-depth articles on modular construction and its impact on the building industry, subscribe to our newsletter at Under the Hard Hat.

1 comment